The name says it all. Can you quite literally and figuratively afford to retire? Did you put away enough money into savings and investments to enjoy a real return?

It is estimated that only 6% of South Africans can afford to retire completely independently of others – a shocking figure.

So why is it that such a low percentage of South Africans are able to retire? The answer is simple. South Africans do not have a mentality of saving. Blame it on low wages, the economy, socio-political background… no matter what the reason, there is no culture of saving.

Remember when you went to the shops with your parents as a kid and asked for basically everything you could get your hands on and your parents just turned around and said “NO”? That’s the attitude you need to adopt yourself to control your own spending.

The wise always say that you should save first, then spend what’s left after saving. This rule applies no matter who you are. You can’t have everything you want and you can’t buy everything you get your hands on. Sometimes you need to make the hard decision and shy away from instant gratification.

You should be saving and putting away about a third of your monthly salary if you want a comfortable retirement. If you are a freelancer of self employed and your monthly income fluctuates, then you should work on projected figures. (Total yearly income, divided by 12). This sounds impossible, but the answer is simple – live below your means!

This money can’t just lie in a bank account either as your interest is so low that you will never see a real growth on capital. You should be investing this money into Unit Trusts, Endowments and ideally Retirement Annuities to get you a greater return on investment through higher interest rates.

So how do you know if you’re putting away enough? The short answer is, you probably don’t… You should speak to a Financial Advisor who is able to do a full financial needs analysis to determine how much money you’ll need on a monthly basis once retired, how long you have left to save and work back from there to determine your ideal monthly savings.

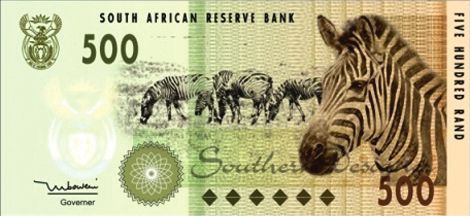

The truth is often times very shocking as you get plenty of advisors running around telling you that you should take out a R500 per month Retirement Annuity if you want to retire. In the grand scheme of things, this won’t even be a drop in the ocean compared to what you should really be putting away!

While it’s always a good idea to start somewhere, and put away something rather than nothing, you should be taking matters into your own hands and be increasing your monthly contribution as often as possible to be able to get to one third of savings towards retirement.

This may seem like a daunting task to face, but the long term reward would be so much more worth it than instant, smaller rewards that will in essence waste your money over the years.

For more information regarding retirement, please make sure to contact the Smart Planner to help get you into the right savings culture, with the right product for you.